Buy Now Pay Later in eCommerce

With the advent of e-commerce and shopping on mobile, the buying habits of an average person, especially from the younger generation, has evolved a lot. E-commerce has constantly kept up with expectations of the customers, adding features and functionality that appeal to them and persuade them to make a purchase online. But one of the most important components of e-commerce that did not catch up with the fast-paced developments was the payment. Credit card has remained the most preferred mode of payment for quite a long time; even with the emergence of new digital payment and wallet options, credit card payments have been the most popular mode of payment. But there are certain inconveniences in using credit cards for online purchase, such as:

- Higher interest rates

- Lack of flexibility in repayment

- Greater upfront cost, especially for larger purchases

- Hidden fees and additional costs

- Complicated and confusing terms of service

- Increased debt load

- Mandatory collection of personal information in many cases

Due to these factors, shopping cart abandonment at payment gateway is not so uncommon. So, changing times and the rise in need for a better payment option paved way for BNPL.

What is BNPL?

BNPL stands for Buy Now Pay Later. As the name suggests, BNPL is a financing option that enables the customers to make a high value purchase instantly without having to pay a high upfront cost, by breaking down the payment into multiple installments. It eliminates hidden costs, fees and high rate of interest, as long as the customer meets the payment deadlines. As a result, Buy Now Pay Later is gradually gaining traction as a flexible payment option that does not burden the customers with increased debt load.

How does Buy Now Pay Later work?

The buy now and pay later options offered by service providers who partner with the e-commerce businesses are integrated in the checkout process of the e-commerce sites. While availing this option:

- 1. The customer chooses the Buy Now Pay Later option from a service provider, in the checkout page.

- 2. He/she selects the number of equally spaced installments.

- 3. He/she can also choose to pay in full after a 30 day period

- 4. Depending on the number of installments and the conditions laid out by the service provider, he/she can opt to pay without any additional fees or interest as long as he/she pays the installment amount on time every single time before the deadline.

- 5. If the duration of the payment period/number of installments is high, say for around 24 months, the customer may have to pay a small rate of interest.

- 6. The payment/installment amount is directly taken from the payment card.

- 7. The merchants pay the service provider a commission and a fee for every transaction.

Advantages of selecting Buy Now Pay Later payment option for customers

1. A modern payment solution for today’s needs

The younger generation get a modern payment option that suits their lifestyle and offers great benefits over traditional payment options. Buy Now Pay Later option simplifies payment, streamlines the shopping process and makes purchasing things easier by enabling instant approval and smooth checkout. A soft cheque is enough for the customer to get an instant approval.

2. An easy, convenient and flexible payment option

BNPL allows the customers to conveniently order products in advance during holiday season without having to wait for enough cash to make large purchases. It lets customers to split the payment into equally spaced installments and makes purchasing high-value items easy. The customers can now choose a flexible payment option without having to pay additional costs and hidden fees.

3. Buy Now Pay Later is more cost efficient

By avoiding high rates of interest, additional fees and hidden costs, the overall price paid by the customers comes down. As a result, this payment method is more affordable and cost efficient.

Advantages of Buy Now Pay Later services for e-commerce businesses

1. Buy Now Pay Later increases average order value

Since the customers can pay in installments over a long period of time, they can make purchases of value that day otherwise could not. As a result, the average order value of the business increases, making a positive impact on profitability.

2. Buy Now Pay Later helps increase sales

Buy Now Pay Later offers flexibility and convenience for customers. Since they can pay later in installments, customers do not have to think twice before purchasing expensive products. With less amount to spend upfront on purchases, customers are also comfortable with buying more from the e-commerce business. These factors play an important role in increasing sales.

3. Buy Now Pay Later increases sales conversion

Abandoned carts or a major problem in e-commerce. It mostly occurs due to the customers changing their mind during checkout or being indecisive about making purchases due to the complexities in payment options, such as hidden costs and additional fees. By eliminating all these, Buy Now Pay Later reduces the instances of abandoned carts and improves sales conversion.

4. One more payment option keeps competition at bay

Integrating different payment options is key to business success, as the customers expect e-commerce businesses to offer them multiple choices for payment. Buy now pay later is quite distinct compare to traditional payment options such as credit card, and the number of customers who make a purchase only because an ecoomerce site has BNPL option is increasing significantly. Integrating BNPL gives a compelling reason for customers to buy from your e-commerce site instead of going to your competitors. As a result, you can retain your customers, fight the competition better and maintain your advantage and market position.

5. Buy Now Pay Later brings in new customers

Buy Now Pay Later is a highly preferred payment method of the younger generation. As they actively seek this payment option, if you have BNPL, you have a higher chance of winning over those customers compared to a competitor who does not offer that option.

6. Buy Now Pay Later adds value

By integrating a customer friendly payment option, you can earn the trust of the customers and convert the customer loyalty into repeated purchases.

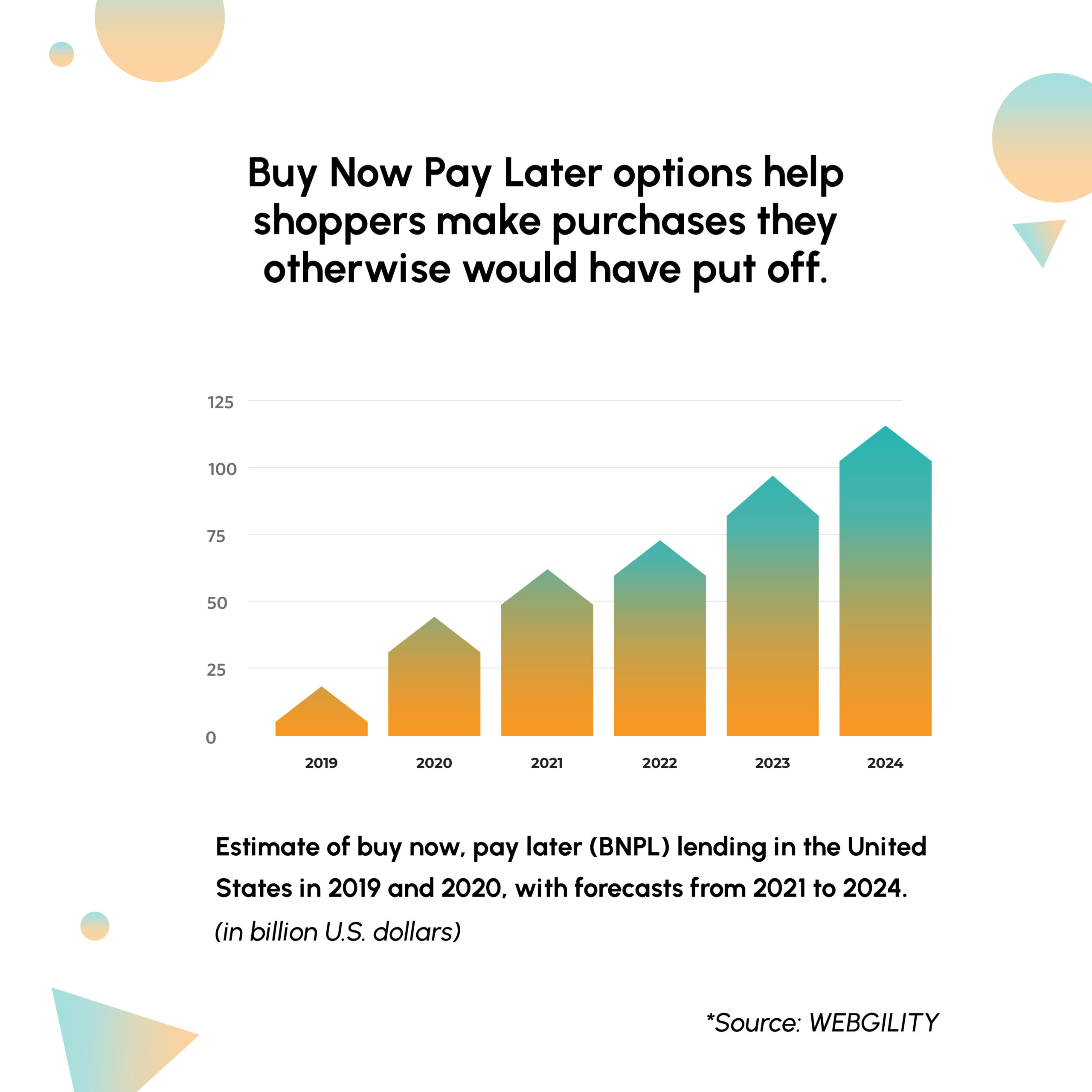

Buy Now Pay Later: Facts and figures

71% of consumers say that they have been making more online purchases during the pandemic.

30% of all the payments for digital shopping were made with credit cards.

55% of online shoppers abandon cart due to hidden extra costs.

Interest rates on US credit cards rose beyond 17% in 2019.

55.8% of consumers have used BNPL service, up from 37.65% in July of 2020 — an increase of almost 50% in less than one year.

61.16% of customers between the age of 18 and 24 had used Buy Now and Pay Later option by March 2021.

41% say they have used BNPL service during the pandemic to conserve cash in case of an emergency, while 25% say it’s because they lost income.

It is expected that there will be 1.5 billion BNPL users worldwide in 2026.

48% of customers said that BNPL solutions allow them to spend 10% to 20% more than they would by their credit card.

30% of BNPL users would not have made purchases without financing options.

62% of buy now, pay later users think it could replace their credit cards.

BNPL service providers

There are many players in the market who offer Buy Now Pay Later services to e-commerce businesses. Some of the most popular service providers are:

- Klarna

- Clearpay

- Laybuy

- Paypal

- Affirm

- Sezzle

- Afterpay

- Splitit

- Perpay